Overview:

This application allows the user to export journals to an Excel spreadsheet and save the template on their workstation or the network. This template can be used to create many new journals or a new journal with multiple lines which can be imported and posted. This can be more efficient than capturing journals one by one. You can also import journal reversals with a specified journal reversal date. On import, the system carries out a validation check. The validation check is applied to Base 1 and Base 2 currencies. If Base 2 is a foreign currency, Base 1 and Base 2 cannot be the same amounts.

Function:

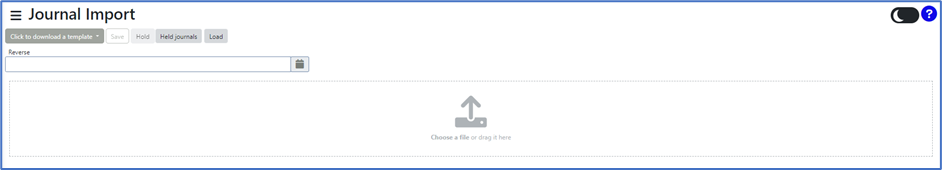

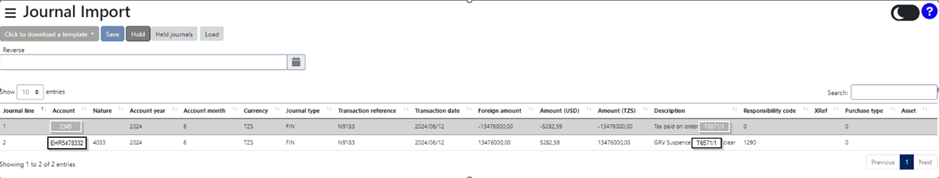

When the application is opened you will view the following screen:

To export a Journal Template, click on the Click to download a template dropdown button and select Export.

Note: You can also download a Blank template.

Blank template.

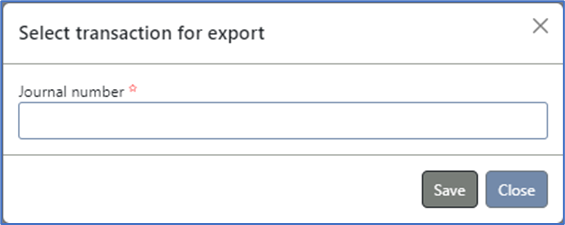

If you click on Export you will be asked to enter a Journal Number to export.

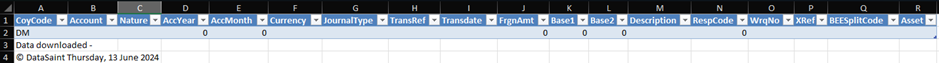

Enter the Journal Number and click on the Save button. Select a save location for the journal. After saving, it will be opened in a Microsoft Excel Spreadsheet.

![]()

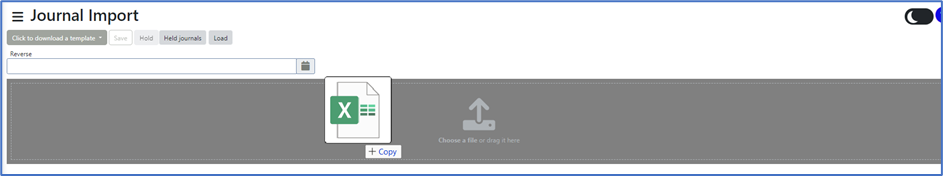

To import a Journal, Click and drag the Excel file from the saved location over to the box in Journal Import that says Choose a file or drag it here. Alternatively, you can also click on the Choose a file or drag it here and then select the location where the Journal Excel file is saved and then select the file.

The transactions you are allowed to post is determined by the transaction types allocated to your profile using Profile Maintenance. Transaction types should be allocated for Journal Import application as well as Journal Capture application.

Workflow routing checks are as follow

•If there is a Valid Alternate Responsibility Tree, use that routing.

•If there is a Default Responsibility setup, use that routing.

•If no other routing exists use the normal Responsibility Tree, however a user capturing a journal must have a responsibility code assigned.

•When a User has access rights “Other” Workflow Approvals are bypassed.

Maximum number of characters that can be used in the Excel for Imports:

![]()

CoyCode: 10 Characters. E.g. DM

Account: 20 Characters. E.g. EHR5478332

Nature: 20 Characters. E.g. 4875 (Can be Blank)

AccYear: 4 Characters. E.g. 2024

AccMonth: 2 Characters. E.g. 6

Currency: 10 Characters. E.g. TZS

JournalType: 10 Characters. E.g. FIN

TransRef: 30 Characters. E.g. T6571 (Can be Blank)

TransDate: 10 Characters. E.g. 2024/06/12

FrgnAmt: Amount with 2 decimals. E.g. 1347600.56

Base1: Amount with 2 decimals. E.g. 5282.59

Base2: Amount with 2 decimals. E.g. 1347600.56

Description: 150 Characters. E.g. Tax paid on order (T6571/1)

RespCode: Number with no decimals. E.g. 4875 (Can be Blank)

WrqNo: Number with no decimals. E.g. 50 (Can be Blank)

XRef: 20 Characters. (Can be Blank)

BEESplitCode: Number. E.g. 2 (Can be Blank)

Asset: 20 Characters. (Can be Blank)