Overview

This application enables the user to:

•Define and create a new bank account

•Amend existing bank details and general information

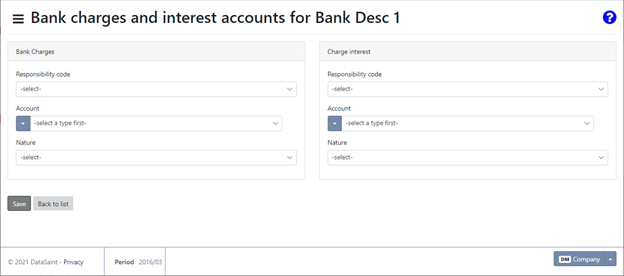

•Define default Cost Centre and Natures for bank and interest charges used when journals are captured for these transaction types during the bank reconciliation process.

Typical Users

Risk Factors

Function

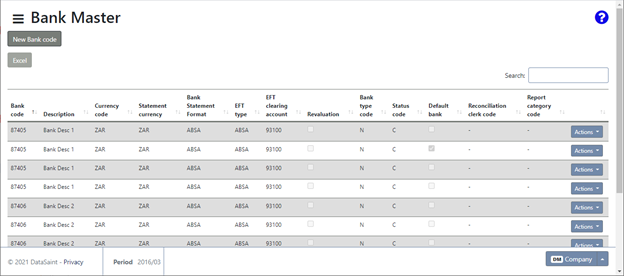

When opened you will view the following:

Use the ![]() button to create a new bank.

button to create a new bank.

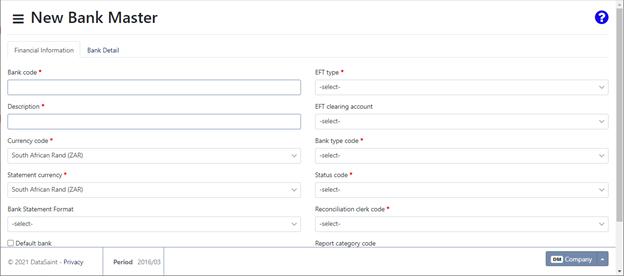

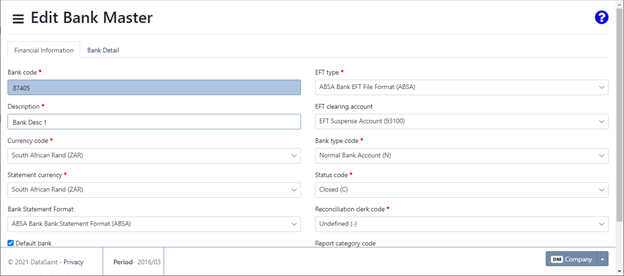

Be sure to complete the Financial Information and the Bank Detail tabs. The Financial Tab requires all the financial information for the new account, the Detail tab requires all the general information about the new account. Enter the information as required.

Select the following information:

•Currency - use the picker to select the relevant currency used for the new bank account, select '-' for multi-currency bank accounts, this allows processing of any currency

•Statement Currency - the Statement Currency will default to the company’s base 1 currency but can be changed

•Statement Format - select the format of the statement

•Status - use the picker to select the Status for the new bank account. Only banks with status A – Active can be used.

•Electronic Funds Transfer Type - select the EFT Type using the picker

•EFT Suspense Account - use the picker to select the suspense account

•Account Type - use the picker to select the type of account

•Recon Clerk - use the picker to select Recon clerk for the account

•Drill Class – select the drill class using the picker

Default Bank tick box – select this option to make this the default bank account to be used for transactions

Cash Book Revalue tick box – select this option to have the cash book revalued.

Once all the fields have been completed, click on the ![]() button to save.

button to save.

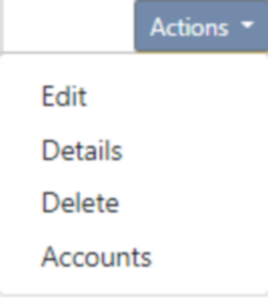

The ![]() button will give you the following options:

button will give you the following options:

Edit allows you to edit existing banks.

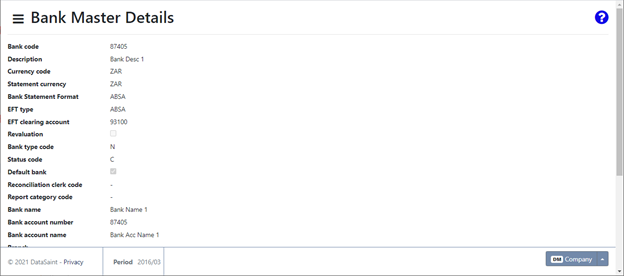

Details allows you to view the details of the corresponding bank.

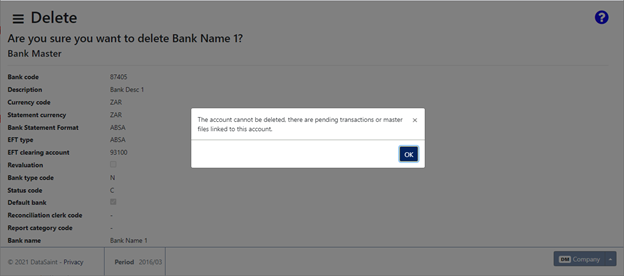

Delete allows you to delete the corresponding bank. You will not be able to delete a bank with pending transactions:

Accounts allows you to assign interest and bank charges to accounts and cost centres.